When we’re watching or reading the news, we often hear about inflation hitting -once again- the consumer price index and increasing the cost of living. Also, when we ask for a loan, we need to pay a certain interest for it. If we own some stocks or government bonds, we might receive also a percentage in the form of dividends or interests.

One key aspect in economics is the compound interest and knowing how it works is crucial for both your business and personal finances, because it can literally speed up your wealth growth or diminish it.

Example:

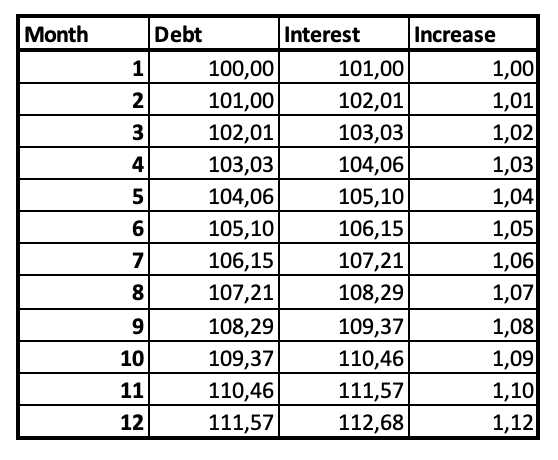

Imagine you use your credit card to buy something you need for 100€. Just for using it, your bank applies 1% of interest per month -i.e.12% per year-. At the end of the month you owe the bank 101€. Not a big deal. As it doesn’t seem much, you decide to use again your credit card to finance those 101€ to buy something else that you need. The interest rate is again 1%. However, now you have to 102,01€. You repeat the process, and now you owe 103,02€. At the end of the year, you’ll owe 112,68€.

Note that if you do the math, the equivalent is 12,68% and not 12% per year. This is called the Annual Percentage Rate, but we’ll not talk about this now so that we don’t get distracted from the main topic.

Still, it seems like a ridiculous amount. In the end, it’s just 12,68€. However, imagine just for a minute that you borrow 3.000€ instead. After 12 months you owe the bank 3.380,46€. Now it’s 380,46€. It’s starting to get scary, isn’t it? You can try to use even bigger amounts, if you don’t suffer from heart problems.

Many individuals follow this approach to handle their finances: a loan for the car, then a mortgage or buy a new computer in installments. Sometimes, as they cannot make it to the end of month, then they again use the credit card. This process is repeated over and over again while the debts grow bigger and bigger.

As you can see in the table here below, every month, the increase is higher than in the previous period.

By continuously financing your needs through external debt, you’re entering into some kind of vicious circle where your liabilities are growing bigger and bigger, leading to a constrained situation which in the worst of the cases, it won’t possible to meet payments or financial institutions will have no other options than seizing your belongings.

Of course, I’m not saying that asking for a loan or using your credit card is a bad thing. Sometimes we need these funds to help our business grow and overcome temporary situations where an overdraft is needed. We just need to be careful and not rely overly on them.

Knowing how the interest compound works can help us understand inflation. In a situation where inflation is high year after year, the speed at which we are losing purchasing power, can be, so to speak, worrisome.

On the other hand, you can turn the compound interest to your advantage. What if instead of borrowing money, you’re the one who lends it? Or better said, invest it? Here the effect will be totally opposite.

Investors usually use the compound interest to their advantadge. For example, in the stock market, they might get dividends that later they reinvest to generate more dividends in the future. Thanks to the compound interest, they are able to buy additional investments with the earnings they made. Repeating this process over time allows them to increase their wealth exponentially.

Note that before investing in the stock market, it is necessary that you educate yourself in financial literacy.

In your business, you can do the same. In a period when there is a surplus of cash, instead of keeping it in your bank account, it is advisable to use it to invest it in your business to increase its capacity to generate more revenue, reduce costs or become more competitive by acquiring new assets, invest it or if possible, to pay out outstanding debts to avoid them from generating additional financing costs.

I hope you enjoyed the article. If you need some advice or consultancy, feel free to drop me a message in the contact form.

Thank you very much for reading.

Leave a reply to Understanding bad expenses and bad debt – Business Advice For Small Companies, by Jorge Cancel reply